Ira calculator 2020

Contributions are made with after-tax dollars. Whether you are looking for a retirement score or a retirement income calculator Fidelitys retirement tools calculators can help you plan for your retirement.

Pin On Parenting

You can print the results for future reference and rest assured your data will not be saved online.

. If your spouse is more than ten years younger than you please review IRS Publication 590-B to calculate your required minimum distribution. Traditional IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. Protect your retirement with Goldco.

While long-term savings in a. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. Reviews Trusted by Over 45000000.

Ad Build Your Future With a Firm that has 85 Years of Retirement Experience. When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take. You can contribute to a Roth IRA if your Adjusted Gross Income is.

Claim 10000 or More in Free Silver. In 2020 the standard contribution limit is 6000 for individuals and if youre age 50 or older it increases to 7000. With our IRA calculators you can determine potential tax implications calculate IRA growth and ultimately estimate how much you can save for retirement.

Starting the year you turn age 70-12. You can use this calculator to help you see where you stand in relation to your retirement goal and map out different paths to reach your target. Your IRA could decrease 2138 with a Roth Conversion.

This calculator has been updated to reflect the new figures. The SECURE Act changes the distribution rules for beneficiaries of account owners who pass away in 2020 and beyond. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually.

The contribution limit is also impacted by your filing status and whether you participate in a work retirement plan. Determine the required distributions from an inherited IRA The IRS has published new Life Expectancy figures effective 112022. Traditional IRA Calculator Determine your eligibility for a Roth or Traditional IRA.

Compare 2022s Best Gold Investment from Top Providers. This calculator assumes that you make your contribution at the beginning of each year. At higher incomes your tax-deductible contribution to a regular IRA phases out.

It is important to note that this is the maximum total contributed to all of your IRA accounts. This calculator has been updated to reflect the new figures. Retirement income calculator Your retirement is on the horizon but how far away.

Ad Top Rated Gold Co. Ad Diversify Your Retirement Portfolio by Investing in a Precious Metals IRA. Determine the required distributions from an inherited IRA.

Roth IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. If you want to simply take your inherited. DENOTES A REQUIRED FIELD.

While long term savings in a Roth IRA may produce better after-tax returns a traditional IRA may be an excellent alternative if you qualify for the tax deduction. Less than 140000 single filer Less than 208000 joint filer Less than 139000 single filer 2020 tax year. Expected Retirement Age This is the age at which you plan to retire.

The SECURE Act changes the distribution rules for beneficiaries of account owners who pass away in 2020 and beyond. Please speak with your tax advisor regarding the impact of this change on future RMDs. Comparison Calculator RMD Calculator.

Request Your Free 2022 Gold IRA Kit. Less than 140000 single filer 2021 tax year. By thousands of Americans.

Ad Visit Fidelity for Retirement Planning Education and Tools. The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status. Calculate your traditional IRA RMD Your date of birth Account balance as of 1231 of last year Is your spouse the primary beneficiary.

Account balance as of December 31 2021 7000000 Life expectancy factor. For 2022 the maximum annual IRA contribution of 6000 is an unchanged from 2021. How is my RMD calculated.

Calculate your earnings and more. Yes Spouses date of birth Your Required Minimum Distribution this year is 0 How is my RMD calculated. The contribution limit increases with inflation in 500 increments.

You can adjust that contribution down if you plan to. AARP Updated May 2022 Traditional IRA Calculator Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. Amount You Expected to Withdraw This is the budgeted amount you will need to support your personal needs during retirement.

The IRS has published new Life Expectancy figures effective 112022. This convert IRA to Roth calculator estimates the change in total net worth at retirement if you convert a traditional IRA into a Roth IRA. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

Annual Interest Rate This is the annual rate of return you expect to earn on your. Less than 206000 joint filer 2020 tax year. Retirement Withdrawal Calculator Terms and Definitions.

Inherited IRA RMD Calculator.

Cook County Il Property Tax Calculator Smartasset Retirement Calculator Retirement Strategies Savings And Investment

Pin On Dmm Daily Money Manager

Phone Number Finder Reverse Check Any Number Mortgage Payoff Mortgage Repayment Calculator Ira Investment

Retirement Withdrawal Calculator How Long Will Your Savings Last In Retirement Updated For 2020 Investing For Retirement Personal Finance Lessons Spending Money Wisely

Retirement Calculator With Inflation In Simple 4 Steps Know How Much Need To Save Retirement Calculator Retirement Planning Retirement

Growing Your Tsp Retirement Benefits Institute Retirement Calculator Retirement Planner Retirement Benefits

Online Pension Calculator 2020 Pakistan Retirement Calculator With Pen Retirement Calculator Pensions Calculator

Hdb Valuation How Do I Figure Out How Much An Hdb Flat Is Worth Home Buying Process Premium Calculator The Borrowers

Defined Benefit Pension Calculator Cetv Calculator Pensions Salary Calculator

What Is Net Worth And How Do You Calculate It Knowing Your Net Worth Can Be An Extremely Useful Finance Tool As You Moni Net Worth Financial Health Budget App

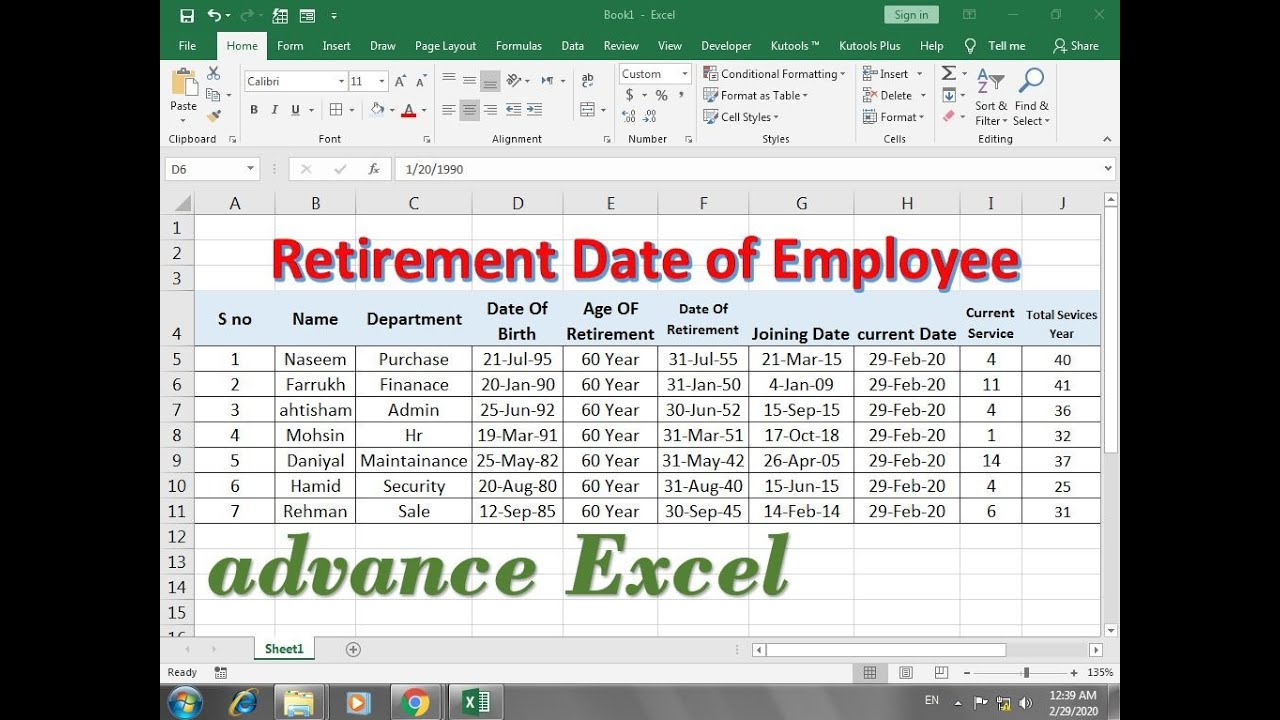

Retirement Calculator Excel Formula Excel Formula Retirement Calculator Formula

Roth Ira So Let S Say You Put Away The Maximum 5 500 Each Year And Continue To Put Away That Amount Adjusted For Inflation Wealth Building Roth Ira Wealth

Pin On Usa Tax Code Blog

Roth Vs Traditional Ira How To Choose Family And Fi Roth Ira Investing Traditional Ira Roth Ira

Rrsp Over Contributions How To Fix Them Your 2020 Guide Retirement Savings Plan Retirement Calculator Fix It

Download Roth Ira Calculator Excel Template Exceldatapro Roth Ira Calculator Roth Ira Ira

Syfpzufxyhj26m